◎ The renminbi devalued and property prices soared on three previous occasions when China resorted to irregular injection of liquidity.

On June 6, the People’s Bank of China (PBoC) loaned 463 billion yuan ($72.43 billion) to financial institutions through its 1-year medium-term lending facility (MLF) at an interest rate of 3.3 percent.

After rolling over 259.5 billion yuan of loans maturing in June, the central bank would add a net 203.5 billion yuan of liquidity.

The backdrop:

On June 1, the PBoC expanded the guarantee scope of its MLFs to include small-and-micro companies (not below “AA” rating), green and agricultural financial bonds, and highly rated loans (“AA+” and “AA” rating) of small companies.

The big picture:

As of May 21, Chinese companies have defaulted on at least 18 bonds worth more than 15.9 billion yuan ($2.49 billion). On May 29, a subsidiary of the state-owned China Energy Reserve and Chemicals Group defaulted on a $350 million three-year bond.

Our take:

1. The PBoC may not want to admit that the 463 billion yuan injection via MLF that uses “junk” bonds is a form of quantitative easing. But the renminbi’s creditworthiness would definitely take a hit from the irregular injection of liquidity, leading to currency devaluation. This indicates that China’s economy continues to worsen, and it is in no condition to withstand a trade war with America.

2. The renminbi devalued and property prices soared on three previous occasions when China resorted to irregular injection of liquidity.

1999-2005: The so-called “Big Four Banks Shareholding Reform” transformed the Bank of China into a commercial bank, but lead to property prices rising nonstop until the 2007 global financial crisis.

2008-2009: China rolled out a 4 trillion yuan economic stimulus package to cope with the global financial crisis. The stimulus package saw local government debt grow through deficit spending and investments, while property prices doubled in a year.

2015-2016: Local government bonds were used as collateral. After China’s foreign reserves fell sharply in 2015, the Ministry of Finance, PBoC, and China Banking Regulatory Commission launched a trillion-yuan bonds-for-debt swap in May 2015. In August, the PBoC carried out exchange rate reforms and the renminbi depreciated by 2 percent. As a result, property soared by as much as 34.8 percent in 2016.

3. The central bank expanding its scope of MLF collateral could see an increase of pledged scale by 400 billion to 600 billion yuan according to conservative market expectations. Given a 5.63 money multiplier rate in April, the PBoC could create about 2.2 trillion to 3.4 trillion yuan worth of currency.

However, it should be noted that the China Securities Depository and Clearing Corporation Limited excluded “AA” grade bonds from being used as collateral pledged in repurchase agreements. So the use of “AA” grade “junk” bonds as MLF collateral would almost certainly lower the creditworthiness of the renminbi.

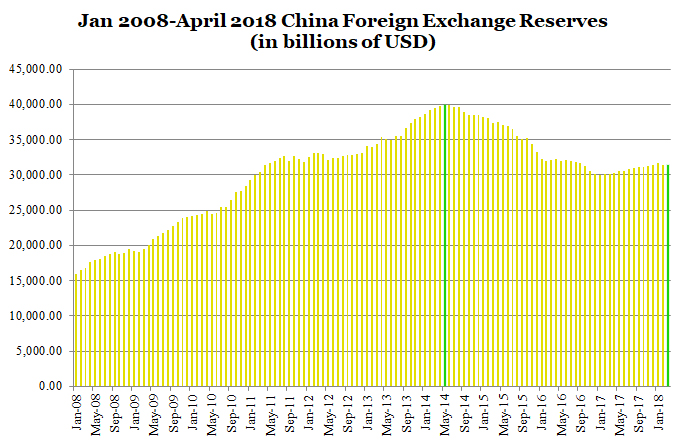

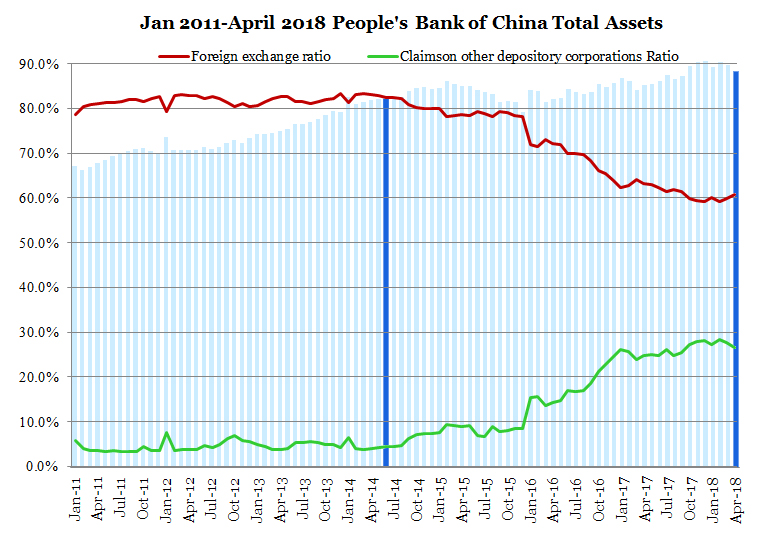

4. From the tables above, China’s foreign reserves reached a peak of nearly $4 trillion in June 2014, fell below $3 trillion in January 2017, and rose to $3.1 trillion in April 2018.

In June 2014, the central bank’s total assets were 32.9 trillion yuan. Total assets rose to 35.3 trillion yuan in April 2018. During this period, the PBoC’s foreign exchange ratio, which accounted for 82.5 percent of its total assets in 2014, fell to 60.9 percent in 2018. Meanwhile, the proportion of claims on other depository institutions grew from 4.4 percent to 26.6 percent.

The renminbi’s creditworthiness is linked with the U.S. dollar. When China’s foreign reserves decrease, there should be a corresponding decrease in base money supply. But the PBoC has instead increased loans to commercial banks and other depository institutions to create more base money, and greatly weakened the renminbi’s creditworthiness.

5. Presently, the prices of second-hand homes in China are higher than that of new homes. The central bank’s latest round of “QE” should further inflate the already massive property bubble, but the central government would likely find ways to prevent the property bubbles from expanding substantially. And if the central government takes action, the likelihood of the renminbi depreciating would increase.

6. We believe that the PBoC may simultaneously raise interest rates and lower its reserve requirement ratio (RRR) in future. In this scenario, China would face an economic disaster if America imposes tariffs on Chinese imports. So China would almost certainly make major concessions to the U.S. to resolve trade tensions. Beijing may even hasten the opening up of Hainan and accelerate its transformation into a free-trade port.