◎ We have reservations about Beijing’s description of China’s economy.

Based on data released by China’s National Bureau of Statistics on April 17, the country’s economy grew 6.8 percent (about 19.9 trillion yuan) in the first quarter. Chinese officials say that the Q1 GDP data is reflective of a “highly resilient” economy with “huge flexibilities,” and predict a “steady and positive” growth trend.

The backdrop:

1. The trade war between China and the United States is heating up. China is looking to levy $50 billion on U.S. imports, while the U.S. is planning to impose $150 billion worth of tariffs on Chinese products. In addition to the tariffs, the U.S. trade representative office is planning a Section 301 complaint against Beijing restricting U.S. providers of high-tech computing services like cloud computing in China.

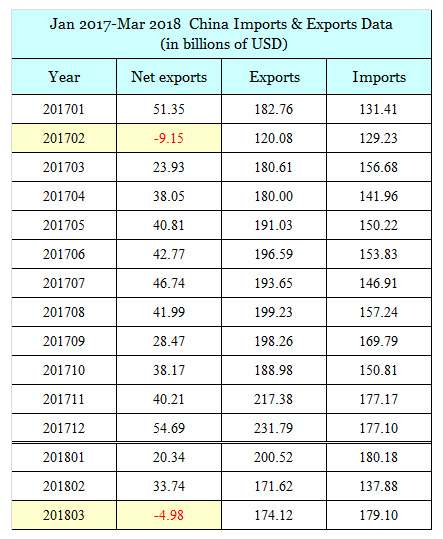

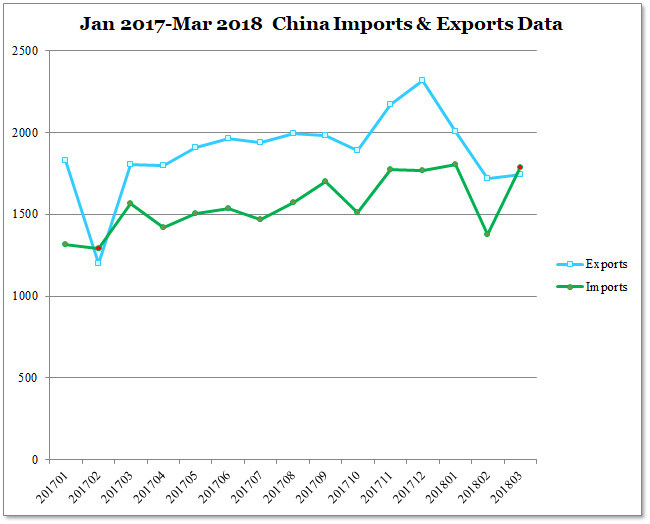

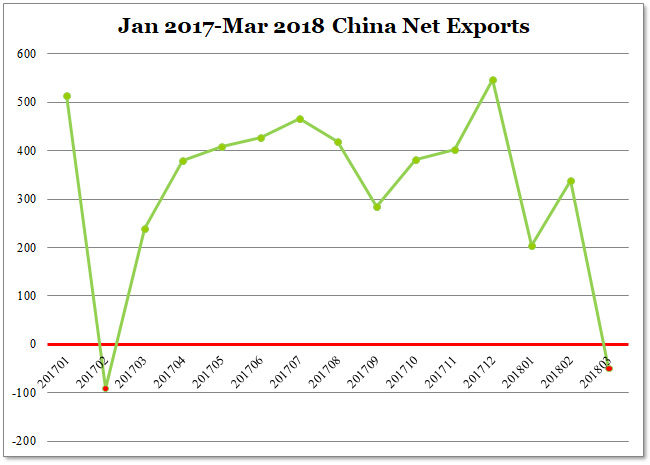

2. Chinese customs data released on April 13 showed that China posted a trade deficit in March, the first time since February 2017.

Our take:

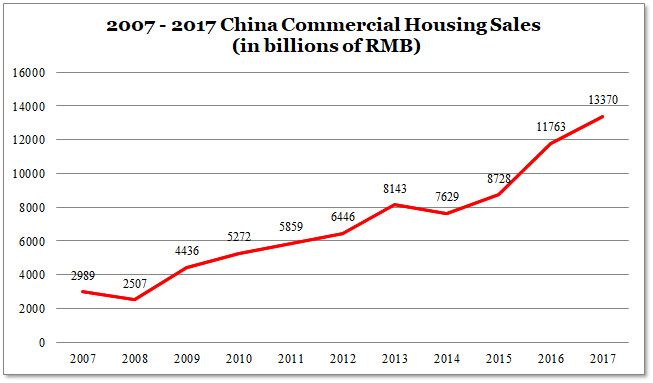

1. We have reservations about Beijing’s description of China’s economy. China posted a trade deficit in the first quarter and it is still very dependent on U.S. exports. In the same period, China’s domestic consumption continues to fall while real estate sales have increased by 10.4 percent year-on-year. In other words, China’s economic growth is still largely driven by real estate sales.

2. According to customs data, China’s export trade surplus in the first quarter was $48.4 billion, or a year-on-year decrease of over 26 percent. While China usually sees a seasonal export deficit in February, this is the first year since China joined the WTO where the first quarter deficit of goods and services totals more than $20 billion.

China remains dependant on exporting to the U.S. at the onset of a Sino-U.S. trade war. China’s net exports to the U.S. in the first quarter were nearly 30 percent higher than its overall net exports, a situation last seen in 2011. Importers of U.S. goods could have increased shipments in anticipation of the coming tariffs. However, China’s net exports to the U.S. are still 4.5 percent higher than its overall net exports even after subtracting the $12.3 billion difference from the first quarter of 2017.

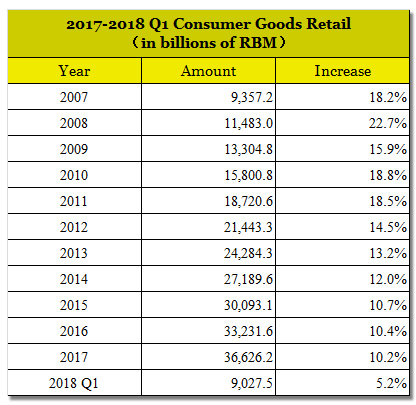

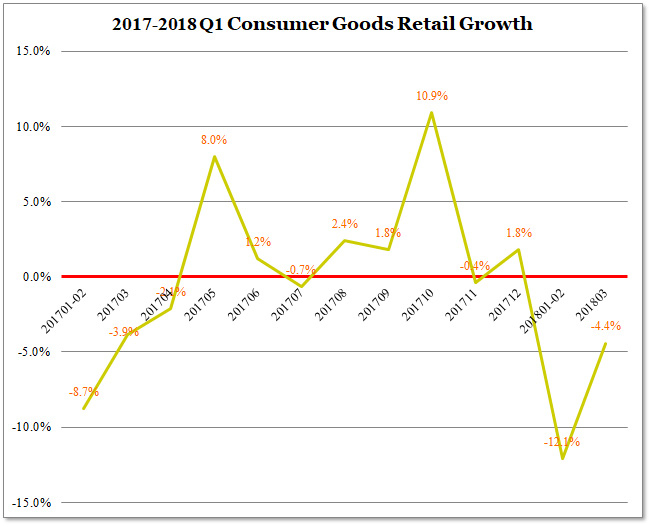

3. Total retail sales of consumer goods was 902.8 billion yuan in the first quarter, a 5.2 percent increase from the first quarter of 2017. This is the second lowest increase since international sanctions were imposed on China after the Tiananmen Square massacre in 1989 (2.5 percent increase in Q1 of 1990). In recent years, total retail sales of consumer goods have been steadily falling from a peak of 22.7 percent in 2007.

4. Total sales volume and sales area of commercial housing increased by 10.4 percent and 3.6 percent respectively year-on-year in 2018. The trend of real estate sales over the past 11 years is just the opposite of retail sales of consumer goods, and indicates that the Chinese people have invested a good portion of their money in property.